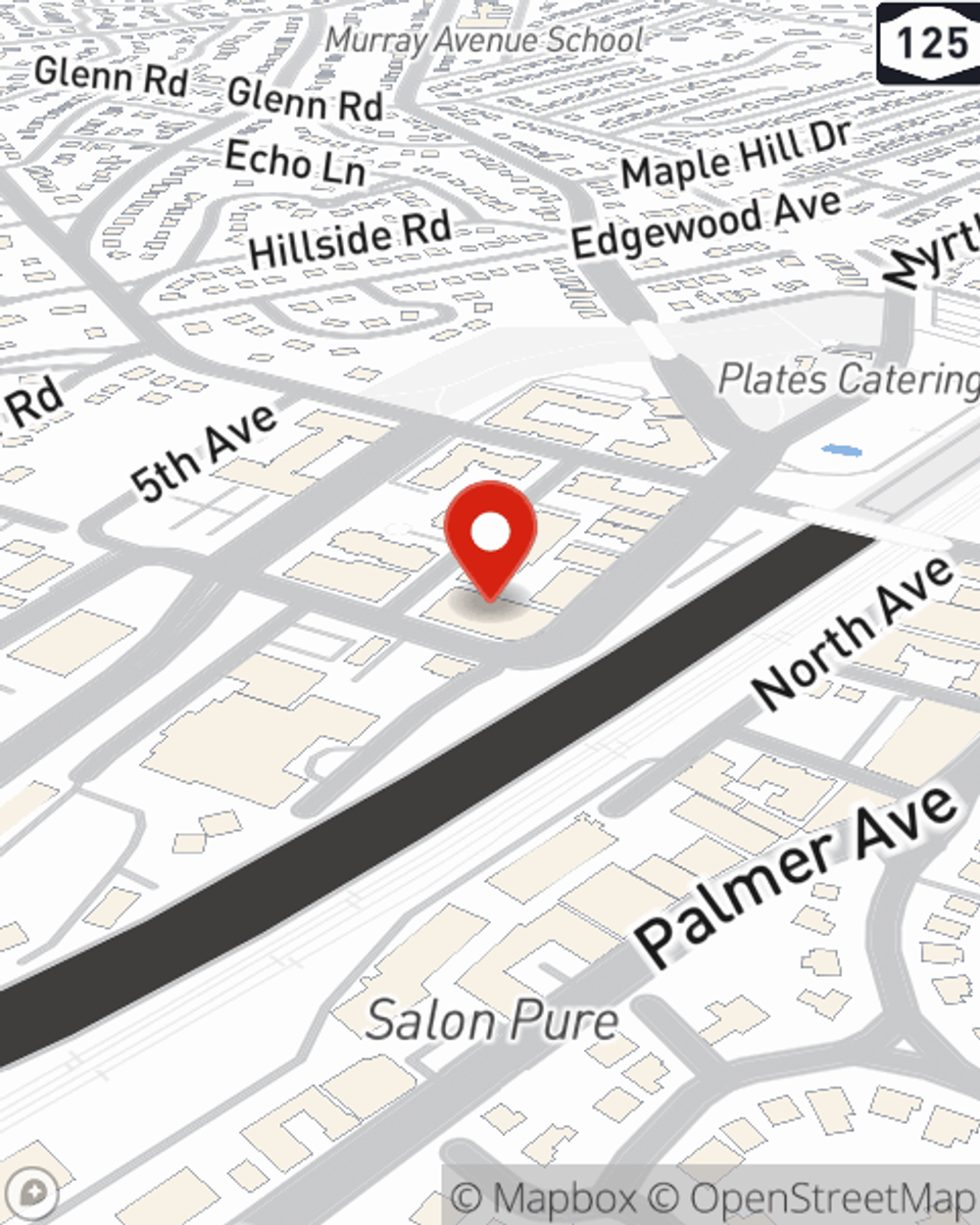

Life Insurance in and around Larchmont

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

When you're young and your life is ahead of you, you may think Life insurance isn't necessary when you're still young. But it's a good time to start talking about Life insurance to prepare for the unexpected.

Protection for those you care about

Life won't wait. Neither should you.

Life Insurance Options To Fit Your Needs

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Greg Long can help you with a policy that works for you.

Did you know that there's now a life insurance option available that's perfect for anyone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really prove useful when it comes to covering the costs associated with final expenses like medical bills or funeral costs. Don't let these expenses burden your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Greg Long and see how you can be there for your loved ones—no matter what

Have More Questions About Life Insurance?

Call Greg at (914) 315-9900 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®